Page 1 of 9

Club investment strategy discussion thread

Posted: Sun Jun 28 2020 10:01pm

by garindan

This is a new open-ended thread to discuss our club's investment strategy, further to the suggestion made by Beachboy.

So our current strategy is based upon buying shares in blocks of ~£1000 in riskier companies, seeking a share price gain rather than income via dividends. We currently use The Share Centre for our share trading as it was the only company we could find that allowed members to join using an individual membership application form that did not require signatures from all existing members.

Please use this thread to provide any thoughts on our current and future strategy - please keep on topic and discuss politely

Re: Club investment strategy discussion thread

Posted: Mon Jun 29 2020 8:46am

by Beachboy

Thanks for setting up. Let's keep it friendly, constructive, focussed and importantly on topic!

Re: Club investment strategy discussion thread

Posted: Thu Jul 02 2020 4:17pm

by richard@imutual

So here's my 2p worth (some of which is just repeating earlier posts!)...

The club should aim to spread its funds across a few different stocks but not so many that we can't devote enough time for proper analysis. As we only have 15 members (of which only 3 or 4 actively contribute on this forum) I'd say that means a maximum of around 5 investments

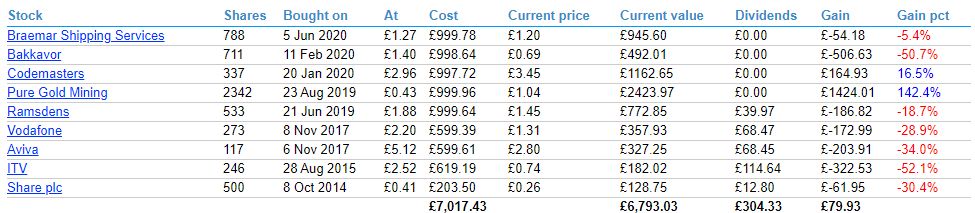

At the time of writing our portfolio looks like this

- portfolio.jpg (60.88 KiB) Viewed 4925 times

I think the switch of focus onto small cap stocks has been a good one. I think we are somewhat unlucky with the covid-related hits to Bakkavor and Ramsdens, and would expect these to bounce back in time

I am rather tired of staring at the sea of red represented by older "blue chip" stocks i.e. Aviva, Vodafone and ITV. They are also rather pointless distractions; our investment in PGM is worth 13x what we have in ITV. Even if ITV doubled in price (unlikely), we'd still be showing a significant loss and it would have minimal impact on our overall portfolio. For these reasons, I'd sell these 3 stocks and release the cash to invest in a small cap - possibly topping up Bakkavor or Ramsdens

Re: Club investment strategy discussion thread

Posted: Thu Jul 02 2020 4:29pm

by garindan

richard@imutual wrote: ↑Thu Jul 02 2020 4:17pm

I am rather tired of staring at the sea of red

In something related to this - I'd very much like us to combine the current and previous investment reports to see everything on one page. Here we would be able to see not only what we have currently but what has happened. I think this would give a far better impression of events. I know this should be an east "fix". Additionally, what would be nice, is to be able to have the current price on the past investments to see where they have gone and how we fared. I guess this would also be a re-use of the code from the current investment report for the current price.

There are a couple of reasonably simple adaptations that could be applied to make the reading of these reports even more useful.

Re: Club investment strategy discussion thread

Posted: Thu Jul 02 2020 4:57pm

by parchedpeas

be able to have the current price on the past investments to see where they have gone and how we fared

This!

Re: Club investment strategy discussion thread

Posted: Thu Jul 02 2020 5:41pm

by BeautifulSunshine

I'd like to see the imutual Cashback Investment Club allow us to, at the click of a button, morph the Current Investments Report into a lean and mean bar chart.

Re: Club investment strategy discussion thread

Posted: Fri Jul 03 2020 7:41pm

by richard@imutual

Well by all means start a"More things we'd like the treasurer to do" thread (though my time is very limited), but isn't this one supposed to be about discussing investment strategy?

Re: Club investment strategy discussion thread

Posted: Tue Jul 07 2020 10:13am

by garindan

richard@imutual wrote: ↑Thu Jul 02 2020 4:17pm

I am rather tired of staring at the sea of red represented by older "blue chip" stocks i.e. Aviva, Vodafone and ITV. They are also rather pointless distractions; our investment in PGM is worth 13x what we have in ITV. Even if ITV doubled in price (unlikely), we'd still be showing a significant loss and it would have minimal impact on our overall portfolio. For these reasons, I'd sell these 3 stocks and release the cash to invest in a small cap - possibly topping up Bakkavor or Ramsdens

I would personally only want to sell on the blue chip stocks if we were putting the money into PGM. I see that as the share that could "repair" the losses on those share values the quickest and the most likely to do so. I would be happy to sell them, invest the money in PGM and once we have "got back to the original investment" we put into the blue chips when we purchased them, we decided whether to hold or re-invest that element of the PGM holding.

Re: Club investment strategy discussion thread

Posted: Tue Jul 07 2020 4:26pm

by BeautifulSunshine

If that is what other members wish to do I'm happy to go along for the ride.

Re: Club investment strategy discussion thread

Posted: Tue Jul 07 2020 4:46pm

by Richard Frost