So here's my 2p worth (some of which is just repeating earlier posts!)...

The club should aim to spread its funds across a few different stocks but not so many that we can't devote enough time for proper analysis. As we only have 15 members (of which only 3 or 4 actively contribute on this forum) I'd say that means a maximum of around 5 investments

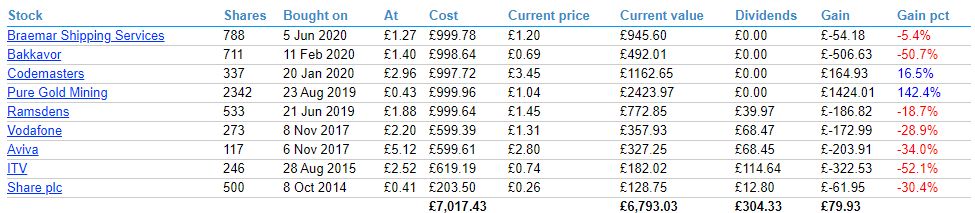

At the time of writing our portfolio looks like this

- portfolio.jpg (60.88 KiB) Viewed 4941 times

I think the switch of focus onto small cap stocks has been a good one. I think we are somewhat unlucky with the covid-related hits to Bakkavor and Ramsdens, and would expect these to bounce back in time

I am rather tired of staring at the sea of red represented by older "blue chip" stocks i.e. Aviva, Vodafone and ITV. They are also rather pointless distractions; our investment in PGM is worth 13x what we have in ITV. Even if ITV doubled in price (unlikely), we'd still be showing a significant loss and it would have minimal impact on our overall portfolio. For these reasons, I'd sell these 3 stocks and release the cash to invest in a small cap - possibly topping up Bakkavor or Ramsdens